Irs Tax Brackets For Seniors 2025. In 2025 (for the 2025 return), the seven federal tax brackets persist: In addition, the standard deduction is $14,600 for.

10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly) 12% for incomes over $11,600. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

Irs New Tax Brackets 2025 Elene Hedvige, There are seven (7) tax rates in 2025. The irs released its 2025 tax brackets.

2025 Tax Brackets Calculator Nedi Lorianne, Here is the main breakdown: Irs tax brackets for seniors 2025.

Tax Rates 2025 To 2025 2025 Printable Calendar, Understand how that affects you and your taxes. The highest earners fall into the 37% range, while.

The table shows the tax brackets that affect seniors, once you include, As in 2025, the marginal tax rate (s) of 10%, 12%, 22%, 24%, 32%, 35%, and 37% will be in effect in 2025. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

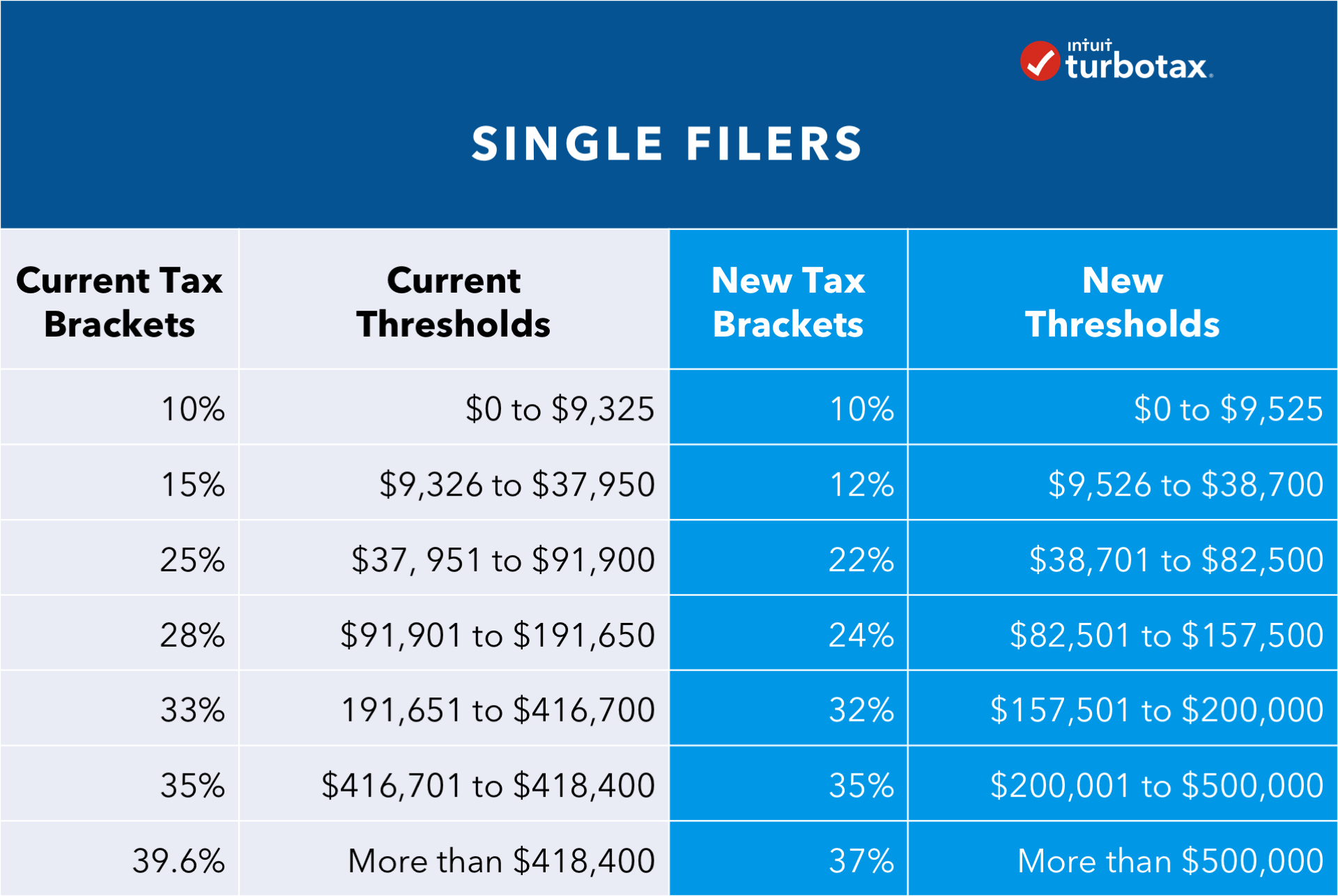

Here are the federal tax brackets for 2025 vs. 2025, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Irs tax brackets for seniors 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 2025 tax brackets for single filers lind harrietta, tax return for seniors, was introduced in 2019. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Tax Brackets Single Nonah Annabela, Irs tax brackets for seniors 2025. Finance ministry clarifies no new tax changes from april 1, 2025.

2025 Irs Tax Brackets Chart Printable Forms Free Online, There are seven federal tax brackets for tax year 2025. For tax year 2025, the additional standard deduction amounts for taxpayers who are 65 and older or blind are:

Irs Tax Brackets 2025 Married Filing Jointly Ambur Bettine, Tax information for seniors & retirees. In 2025 (for the 2025 return), the seven federal tax brackets persist:

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, The form generally mirrors form 1040. For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600.